Principal Industries Announces Acquisition of HanleyLED Brand

The acquisition strengthens and diversifies Principal Industries’ commercial sign and display product portfolio while enabling more choices and greater flexibility for customers.

Home » News

The acquisition strengthens and diversifies Principal Industries’ commercial sign and display product portfolio while enabling more choices and greater flexibility for customers.

Entrepreneur Of The Year celebrates ambitious entrepreneurs who are building bolder futures.

Principal Industries announces the acquisition of SloanLED.

After more than two years of litigation, PLG is pleased to announce that it has favorably resolved the case.

P-LED is the only company ranked in the top 3 in all categories.

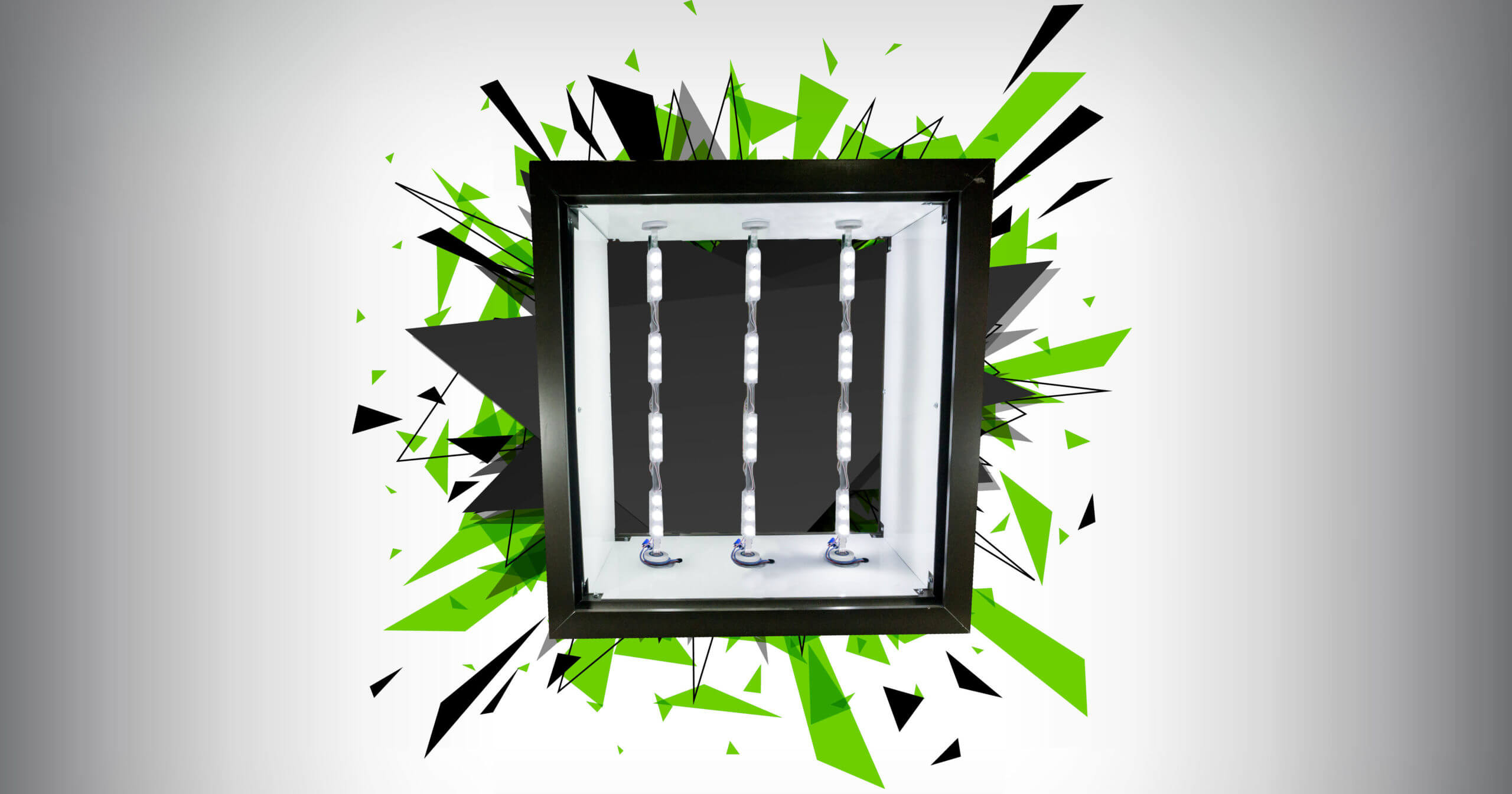

P-LED introduces its new 100% U.S.‑manufactured Patriot LED, furthering the mission of simplifying the lives of its customers.

It’s Principal LED’s fifth LED-to-fluorescent replacement patent.

It’s a significant upgrade to the platform providing dramatic improvements in productivity for sign shops.

PLG will acquire certain assets of Aries Graphics in a cash transaction.

The entire line of power supplies is now Canadian Standards Association certified.

Adds a patent relating to direct-connect LED retrofit assemblies.

Adds three patents relating to LED assemblies designed for existing light support structures.