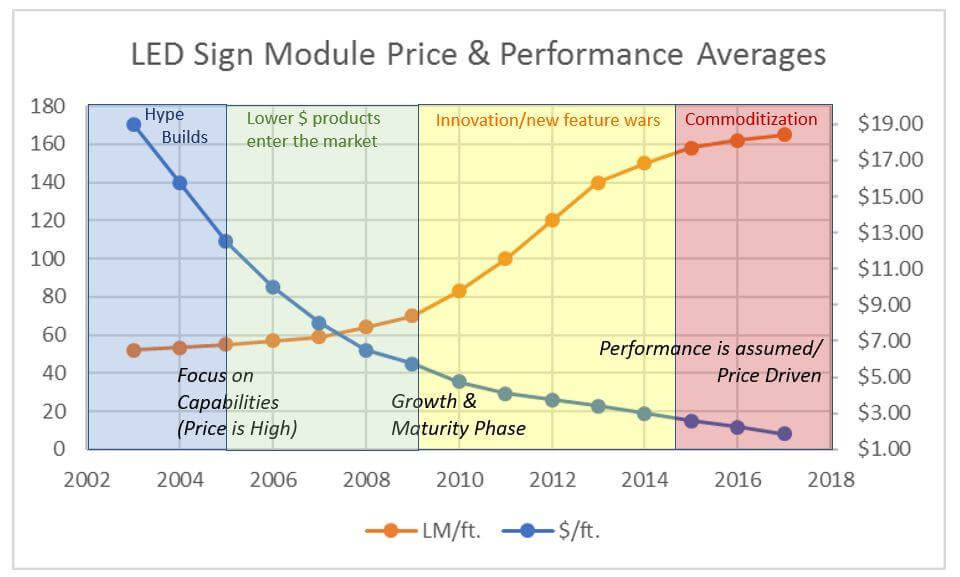

Well, here we are. When I was asked to write an article on LED channel letter modules, I thought to myself, what else is there to really write about that hasn’t been said? I began to reflect on my 15 years manufacturing sign modules and the massive changes that I have witnessed over that period. It has truly been extraordinary. Prices were high and so was the LED “hype.” The technology was new and reliability and long-term performance were questionable at best. Neon was dominant and these “little” modules were positioning themselves to disrupt what had been the status quo for more than 50 years in a “big” way. And so, it happened. LEDs module manufacturers began to develop capabilities and features that sign makers needed.

Standardization and Innovation

It may seem understood that when you buy an LED module today that it has a VHB tape on the back or that it’s going to be 12VDC input. However, that was not always the case. LED module makers learned by trial and error what sign makers wanted, and slowly began to standardize. I remember LED modules that were purely mechanically mounted, white modules that you had to buy in batches like vintages of fine wine, and voltages that were all over the place – 3.6V, 9V, 15V, 24V, 36V (remember the original GE dipswitches?). As capabilities became more standardized, competition began pouring in and driving down prices; however, the performance grew incrementally.

In 2009-2010 LED modules entered a second wave of innovation (thanks in part to the general lighting market). During this phase, lumen outputs grew substantially and new features making modules easier to install became incorporated into basic designs. From 2012-2015, module makers began adding more features, making waterproof modules and adding secondary optics to better distribute light across the sign surface, reducing install times by using fewer modules and making a more evenly illuminated sign. New applications bloomed and today we have a plethora of LED modules from tiny to large, all designed to meet the varied needs of custom illuminated signage.

Commoditization

Since about 2015, we have begun one more chapter of LED sign modules — commoditization.

Today, most users assume the reliability/performance and are making buying decisions more and more on price. When I started in the industry, signs went up and were going to be there for 20+ years and well-made neon can last that long. However, our entire society has changed. Technology drove markets to move fast and so did businesses, driving constant changes in image, locations, mergers, and the overall lifetime of a business or brand. Sign fabrication had to adapt and not just with LEDs.

Steel was replaced with lighter, lower-cost aluminum and now ACM and structural plastics. More sign companies than ever only do installations, choosing to rely on the scale of wholesale sign fabricators to provide fast and economical solutions. And it’s not just in signs.

I just bought a 1964 Ford Ranchero truck and I went out to get it restored. In a city of 120,000 people there is only one guy who does real bodywork (and as it turns out, he’s moving). Body shops are in reality panel and parts replacement shops. I could go on and on. Old-timers in our industry understand the analogy.

Looking at the history of the LED commoditization curve and its correlation to other technology products, there is no question that the overall bulk of the LED module market will continue to be price driven in coming years. However, price erosion on a dollar basis will be less dramatic, as the actual LED itself becomes a smaller part of the module cost. I anticipate another 25 percent reduction in average base LED costs over the next 12-24 months. This still means continued lower prices and pressure on smaller module makers to compete.

Lumens and Lenses

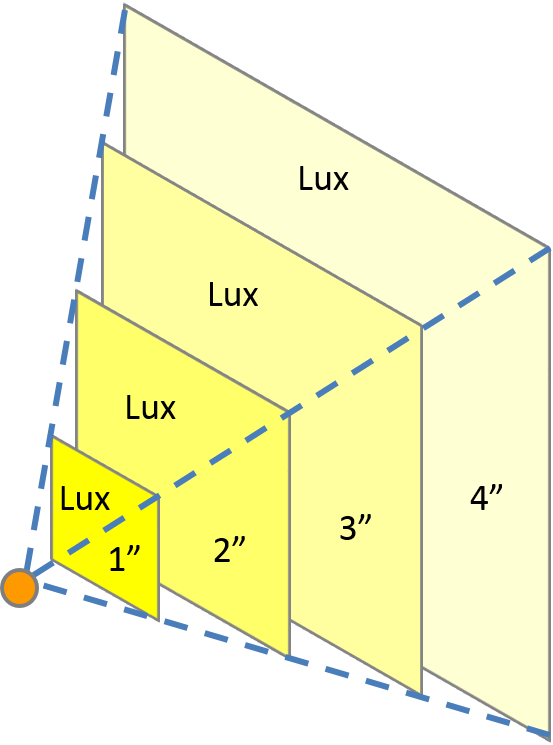

It is also important to note that the brightness (LM/ft.) of basic sign modules will likely flatten, not because they can’t be brighter, but simply that there is a lack of need. Three-inch returns are becoming commonplace and at shorter distances to the sign face, less lumens are required due to the inverse square relationship between light output and distance. For example, if you have a single LED module that is evenly lighting the face of a sign at 1,000 LUX or lumens/m2 and you begin increasing the depth of the sign, the light will drop according to the following relationship or pattern: 1” from the sign face = 1,000 LUX; 2” =250 LUX; 3” = 111 LUX; 4” = 62.5 LUX …

This means that given the same exact LED module, you need only about 25 percent of the number of modules to achieve the same brightness in a 3” depth sign as a 5” depth sign. In practice, however, there is a limit to the realistic spacing, so there is less concern with “lumens per ft.” and more with the evenness of illumination in these lower profile signs.

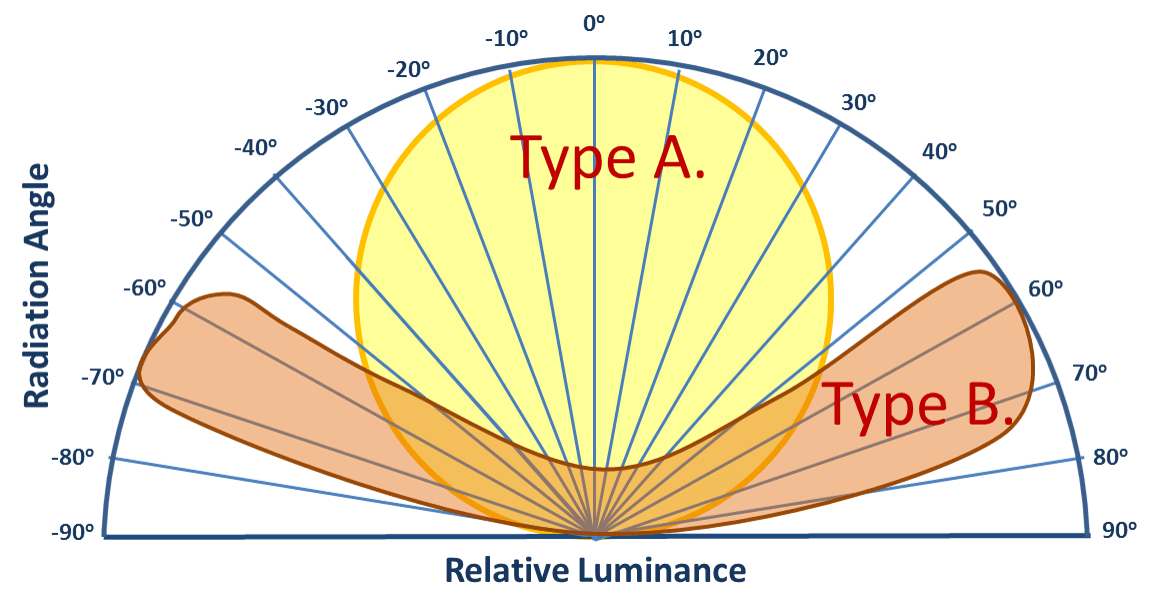

This is being achieved with batwing type optical lenses versus the traditional Lambertian pattern created from a non-optic module. The downside is the optic itself creates a greater “distance,” so technically there is still a place for non-optic modules in deeper and larger channel letters and cabinets. There are folks out there who understand this concept; however, when you are in the product lifecycle phase where there is less interest in features and more interest in price, more and more customers are in the mode of “just give me something low cost that I can use for everything.”

Regardless, it’s not all bleak in the module market. Commoditization means consolidation, and the market seems to be coalescing around fewer key players thus simplifying purchasing and less confusion. It also means standardization of things like white LED color temperature (4,100, 6,500, 7,100K), LED module efficiency (85-100 LM/W) and drivers (12V, 60W), making estimating, installation and service easier.

Silver Linings

The silver lining of the commoditization era for sign manufacturers in all of this is that most all of today’s LED modules perform and are priced to meet the evolving needs of the sign industry. Some of us may not like the evolution, but unfortunately, we don’t control markets — we respond to them.

Modules are priced for the ugly, “disposable” nature of our culture and generally speaking module lifetimes are good enough. Most reputable LED module manufacturers provide third-party LM80 testing that demonstrates adequate life expectancy of the LED in exterior sign applications. This means that you don’t have to make your purchasing decisions based upon “this module feels hot” or “this module is made in country X,” or some makeshift testing in the shop with a $20 light meter that bounces all over the place.

One caution though — use manufacturers that can provide independent data. The data should be taken on the actual finished module, not just the LED inside. LM80 testing is also performed at elevated temperatures of 55°C (131°F) and 85°C (185°F).

At Principal LED, we also add a third dataset at 105°C (221°F) to ensure LED performance even in the hottest outdoor conditions. Another caution: If a manufacturer simply states that every model they make lasts 50,000 or 100,000 hours, disregard. This likely means they haven’t tested it. I recommend looking for an LM80 mark and the manufacturer should be able to provide an L70 report to give an exact extrapolated value from the specific model as sold. However, take the L70 for what it is worth – just an extrapolation. At Principal LED, when we first released our Fusion line of LEDs, we had zero light loss after a 6,000 hour third-party LM80 test. We would not be so arrogant to use the extrapolated L70 data and say the LED module will last indefinitely. What it does say is that the LED light output is very likely to perform beyond the typical life of the application.

Just as important as the LED lifetime are other measures of mechanical integrity such as tensile strength and temperature range of the VHB tape, thermal characteristics of the housing, and ingress protection rating. These are basic considerations and due diligence that should be performed when choosing an LED module provider.

Another Upside

The other upside to the commoditization of LED modules is that there are now smaller and smaller price differences between Tier 1 LED manufacturers and Tier 2 / Tier 3 importers. This means that you can get high levels of service like estimating, warranty, technical service, and next day delivery through sign supply distribution without paying through the nose for that extra service. Additionally, most Tier 1 manufacturers also have a wide range of solutions for various signs, so you don’t have to use a one-size-fits-all approach.

LED modules have been a part of a systematic change in sign manufacturing over the past 15 years. It has been a manufacturing response in lockstep with the sheer speed of a changing marketplace. By the way, there is a final chapter in every product lifecycle that I didn’t share — the disruption phase. This is what happens when the next technology is introduced that steals market share from the previous. I just don’t know when or where it will come from.

If anyone knows, please let me know!